CHAMPAGNE BULLETIN JANUARY 2022

In this bulletin

- Innovations in packaging and marketing

- Crisis. What crisis?

- The future of Champagne

Welcome to the first Champagne Bulletin of 2022 a year that will undoubtedly have its challenges, but one that will also present plenty of exciting opportunities.

This is a longer bulletin than normal. As we look back on the past year and look forward to 2022, this is a chance to consider the ever-relevant issues of supply, demand and prices that will characterise 2023 as indeed they do every other year.

However, before we do that, let’s get started by looking at a few of the innovations happening at the moment.

NFTs

Blockchain technology has been around for some time now, so depending on how familiar you are with it you will either think that these latest marketing moves are well overdue or ahead of the curve.

Whatever your view, NFTs, or non-fungible tokens, are making their first appearance in the world of wines & spirits.

Whatever your view, NFTs, or non-fungible tokens, are making their first appearance in the world of wines & spirits.

Hennessy, the world’s largest brand of cognac, is amongst the first brands to venture into this new area of technology when it launched Hennessy 8 in association with BlockBar, the world’s first direct-to-consumer NFT platform for wine and spirits.

Hennessy 8 is an ultra-premium cognac of which only 250 carafes has been produced

According to The Drinks Business:

The price of purchase will be 58 ETH, a digital currency, or about US$226,450. The transaction is being handled by BlockBar, and details of purchase can be found at BlockBar.com. Potential buyers can access a digital lobby at 9:30 a.m. EST on Wednesday, January 12, providing they have 1 ETH in their wallet and have it connected to the site. At 10 a.m., all users in the lobby will be shuffled into random order, and then BlockBar will proceed through the queue until a buyer is confirmed.

Upon purchase, the cryptographic version will be held for the buyer by BlockBar with a record of authenticity held on the blockchain as a digital certificate of ownership. The buyer may claim the physical part of the transaction and have it delivered from BlockBar’s secure storage facility or trade its NFT version within the BlockBar.com marketplace.

A few days later, on January 18th, another product launch took place: a collaboration between Blockbar and Penfolds of Australia.

You can find out more about these offers and about Blockbar on this link

https://blockbar.com/

I don’t yet know of a champagne house that has launched an offer involving NFTs but I suspect it won’t be long in coming. Meanwhile, other innovations are taking place in Champagne

LABELS - Simple is sometimes best

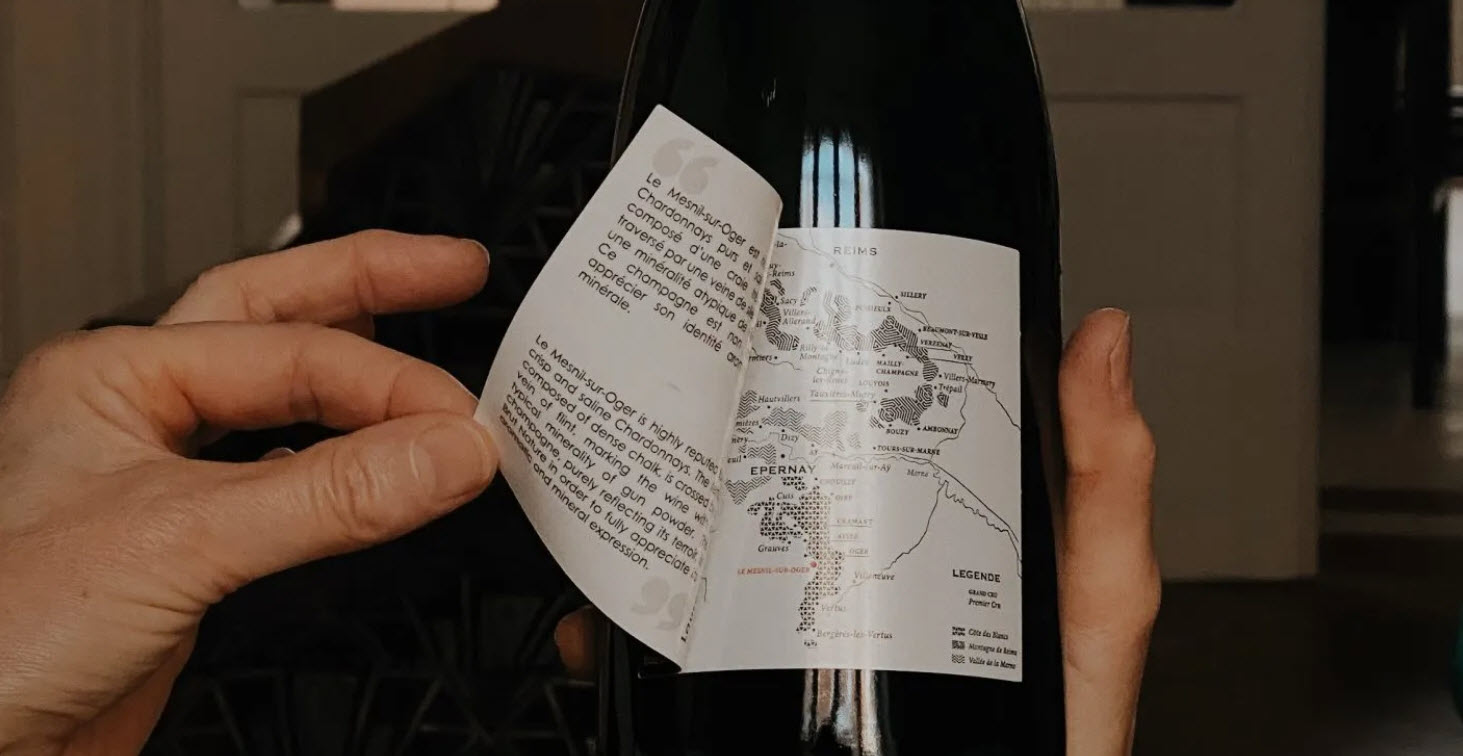

Sometimes, the best ideas are ones that have been staring you in the face for a long time and which are extremely simple to put into practice. Take the question of back labels and the problem that, all too often, mandatory texts take up so much room that there is no space left to tell consumers about your product.

Sometimes, the best ideas are ones that have been staring you in the face for a long time and which are extremely simple to put into practice. Take the question of back labels and the problem that, all too often, mandatory texts take up so much room that there is no space left to tell consumers about your product.

Champagne Lombard has solved the problem by the simple expedient of a back label incorporating a mini brochure. The label peels back to reveal an extra two or three pages on which much more information can be provided about the wine, the Champagne region, or any other marketing message.

Effective though that may be, the idea of a printed back label is still very much a part of traditional technology. However, one house that has gone much further in adopting new technology is La Maison Penet, a family-owned producer of premium champagnes based in the village of Verzy.

Augmented reality

La Maison Penet is no stranger to innovation because, several years ago, it was the first wine company anywhere in the world to use QR codes on its labels. Now they have gone one step further by introducing augmented reality into the labels.

La Maison Penet is no stranger to innovation because, several years ago, it was the first wine company anywhere in the world to use QR codes on its labels. Now they have gone one step further by introducing augmented reality into the labels.

By downloading a free app called Smartbottle on to your mobile phone you can scan the label to bring to life a series of virtual images and sounds that tell you more about the champagne and La Maison Penet itself.

Here's a link to a short video that will show you more.

Golden Oldies

Another marketing idea that is far from new and which was made particularly famous by Roald Dahl in his book Willy Wonka and The Chocolate Factory' is that of a Golden Ticket.

Budweiser is reviving something similar in its most recent promotion.

Budweiser is reviving something similar in its most recent promotion.

A few golden cans have been included in cases of regular cans and a customer who finds one of the golden cans is eligible to win a $1 million prize as part of its “Live Like a King” sweepstake.

There may be many people who feel that this particular promotional device may not be suitable for prestige champagne, but there are a few variations on this theme that could be. Email me if you’d like to chat about this.

But back to Champagne and what the coming year has in store…

THE FUTURE OF THE CHAMPAGNE INDUSTRY

An article in the Economic Observatory (link below) on this very topic comes to the following conclusion:

Analysis of data on the ups and downs of this iconic French industry over more than a century suggests that its future is likely to be brighter than was feared in the early months of Covid-19.

Well, I hate to say ‘ I told you so’ and of course there will certainly be many obstacles in future, but Champagne has known nothing but highs and lows throughout its history and sales have always rebounded after a crisis. In fact, I wrote a series of short articles about this a few years ago. You can still find them on my web site on this link

But, back to 2022 and the Economic Observatory analysis.

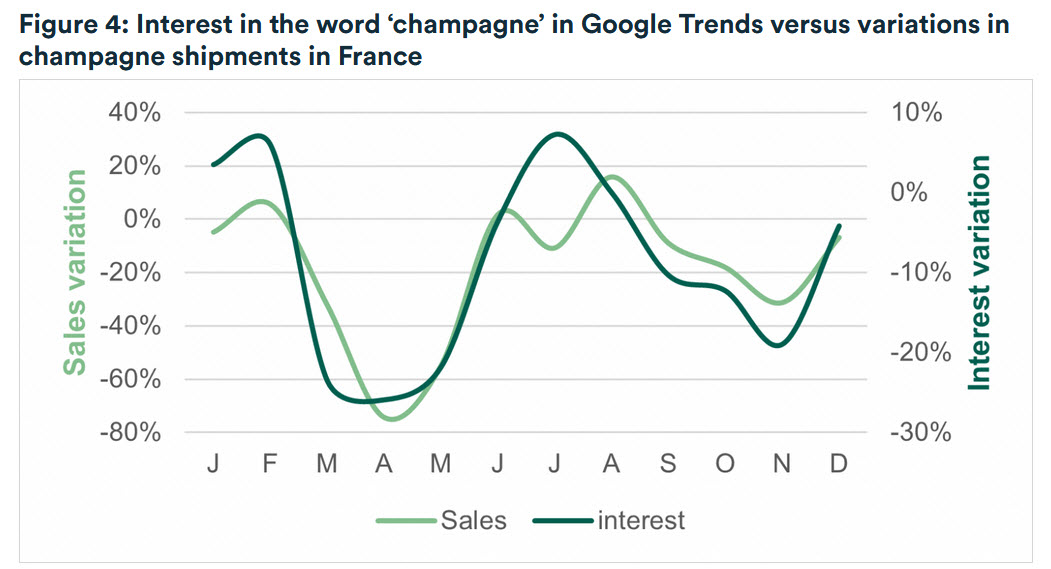

Overall, I don’t think it offers much that is really new, although it does introduce a new way to track global interest in champagne which is the number of searches for the word ‘champagne’ in Google. This mirrors very closely (or perhaps influences) sales of champagne.

Overall, I don’t think it offers much that is really new, although it does introduce a new way to track global interest in champagne which is the number of searches for the word ‘champagne’ in Google. This mirrors very closely (or perhaps influences) sales of champagne.

https://www.economicsobservatory.com/what-future-for-the-champagne-industry-after-the-pandemic

More significant than this analysis is what is actually happening in Champagne right now.

A record year.

The latest estimates indicate that when the figure for total champagne shipments in 2021 is confirmed soon, it will show that champagne significantly outperformed even the most optimistic expectations for the rebound after the last two years. In fact, total shipments (this figure includes exports and shipments to the domestic market in France) look as if they will end up at 320 million bottles, or even slightly more.

The latest estimates indicate that when the figure for total champagne shipments in 2021 is confirmed soon, it will show that champagne significantly outperformed even the most optimistic expectations for the rebound after the last two years. In fact, total shipments (this figure includes exports and shipments to the domestic market in France) look as if they will end up at 320 million bottles, or even slightly more.

That could be the second best year on record (second only to the 338 million bottles shipped in 2007) and what’s more the total value of shipments last year looks likely to reach 5.8 billion euros – which would certainly be a new record.

So, to summarise it would seem that:

- Champagne lost none of it appeal during the pandemic

- People had a pent-up desire to celebrate. Some people continued drinking champagne at home because they had fewer opportunities to do so in bars and restaurants.

- When the on-trade started opening up again people enthusiastically seized the chance to enjoy themselves again and champagne figured largely in those moments.

- Established brands, especially prestige cuvees, benefited because in times of uncertainty consumers tend to gravitate towards brands that offer ‘sure value’ (at least as they perceive it).

- Those people whose incomes had held up during the pandemic had fewer opportunities to spend it on things such as eating out and travel, so they had more disposable money to spend on luxury champagnes and took the opportunity to trade up.

Consequently, as we start a new year there is a widespread, but cautious, optimism in Champagne, although, in my experience, it is highly unlikely that the champenois would ever give way to unbridled enthusiasm, however rosy the future seemed.

Nevertheless, there are still some clouds on the horizon. I’ll touch on two in particular, one concerns champagne as a whole, the other concerns private brands more closely and we can address both these issues by reference to recent comments by the president of Union Champagne, one of the largest and most highly regarded of the cooperatives in Champagne.

The president’s speech every January is seen by some as setting out the key issues for the industry in the coming year and this year he spoke about 1) the supply of grapes and 2) the objective of adding value to the cooperative’s own brand.

SUPPLY, DEMAND AND PRICES

Last year, against the background of collapsing sales, when the time came last year to fix the amount of grapes to be picked at harvest time, the limit of 8,000 kg per hectare was set, or put another way, enough to make just 230 million bottles of champagne, well below the benchmark of 300 million which is about what would be needed for a normal, healthy market.

Last year, against the background of collapsing sales, when the time came last year to fix the amount of grapes to be picked at harvest time, the limit of 8,000 kg per hectare was set, or put another way, enough to make just 230 million bottles of champagne, well below the benchmark of 300 million which is about what would be needed for a normal, healthy market.

The figure of 8,000 kg per hectare was subsequently revised upwards, but the underlying sentiment was one of caution and of the need to prevent over production in a falling market which would lead to excess stocks and consequently, falling prices.

In the event and as we have seen above, sales were hugely in excess of 230 million bottles, so it’s safe to say that the concern about over production did not materialise, in fact the opposite may now be the concern. Hence the call from the president of Union Champagne for a minimum of 11,000 kg to be set as the allowance for this year’s harvest. That’s approximately enough to produce 315-320 million bottles.

A crucial balancing act

The balance between the supply of grapes and the sale of bottles is a crucial one in Champagne. This issue is a hard enough task to manage in any industry, but because of the ageing time required in the production of champagne, it’s even harder: you’re faced with an irreversible decision about supply in year 1 when the demand will not be known until year 3 or 4.

If supply and demand are kept in rough balance, prices will be stable. If there’s more supply than demand prices will probably fall, and the opposite is true if demand exceeds supply.

Having emerged from 18 months of depressed sales with a spectacular and unexpected rebound in 2021, it seems likely that prices will be firming up in 2022.

Adding value

There was another comment in the speech at the AGM of Union Champagne that warrants closer attention, especially from those of my readers who have already embarked on the creation of a private brand or may be considering doing so, not least because this comment gives us an insight into how many other champagne makers will be thinking in 2022 and beyond.

There was another comment in the speech at the AGM of Union Champagne that warrants closer attention, especially from those of my readers who have already embarked on the creation of a private brand or may be considering doing so, not least because this comment gives us an insight into how many other champagne makers will be thinking in 2022 and beyond.

Union Champagne is a large cooperative producing about 10 million bottles each year. Amongst their customers they count Tesco, the U.K.s largest supermarket chain, to whom Union Champagne probably supply several hundred thousand bottles, all under Tesco’s own brand name.

However, their ‘Jewel in the Crown’ is their own brand, Champagne de Saint Gall and it is on this brand that Union Champagne wants to focus, by increasing sales in export markets and by increasing the average selling price per bottle. To achieve these objectives Union Champagne stated that they will continue to reduce the proportion of sales to private labels, to increase prices and give precedence to their best customers.

What does that mean for the private brand business?

The larger champagne producers and particularly those who already have a reputation for the quality of their champagnes, will be very selective about who they work with on private brand projects, if they will agree to do so at all.

To achieve agreement with this category of supplier it will be important to have good pitch that shows solid reasons why the project will succeed such as past experience, existing and relevant skills, access to market and other resources.

Private brand projects that target a premium retail price positioning will be more favourably regarded than entry level projects.

There will still be opportunities for projects that target a mid-range retail price for which the quality of the champagne needs to be good but perhaps not outstanding. There are a multitude of lesser-known champagne makers that offer sound quality and sufficient production capacity to satisfy most sales ambitions.

Prices will be firm and, with associated costs for transport and for the raw materials needed for packaging all still on the increase, it will be all the more important do the financial groundwork at the start of any new project.

---

That’s all for this month’s champagne bulletin but if you’d like to discuss in more detail any of the topics raised, please email me at This email address is being protected from spambots. You need JavaScript enabled to view it. and I’ll respond as soon as possible.

All the best from Champagne