CHAMPAGNE BULLETIN JANUARY 2024

A very Happy New Year to you. I hope it brings you health, happiness and success.

As you will know already, these bulletins are not about tasting notes, nor do they attempt to provide any recommendations about which champagne to enjoy. Instead, they focus on the business of champagne and some of the trends that may have an impact on the business environment and what that might mean for private brands.

Like almost everything else in the world, champagne is subject to cycles that flow one way and then another. These flows sometimes appear to indicate a clear trend, but on closer examination, the underlying influences can tell a more nuanced story.

With that said, In this first Champagne Bulletin for 2024 let’s take a look back on the past couple of years and to what 2024 may have in store for us.

The perpetual see-saw of supply and demand

Unsurprisingly, 2020 was an unusual year for sales of champagne, as it was for everything else, with shipments collapsing to about 245 million bottles as opposed to the customary level of over 300 million bottles.

This led to a good deal of uncertainty and even pessimism about the future: would champagne ever recover and if so, when? At a crucial moment caution and pessimism prevailed, and with signs of a collapse in shipments already apparent in the first half of the year, it was decided to sharply limit the size of the harvest in September 2020 in order to avoid being overstocked and the consequent risk of prices collapsing.

The strategy appeared to work well because shipments in 2021 bounced back strongly and 322 million bottles were shipped. What’s more, the value of shipments reached a record of 5.7 billion euros.

Great news you might at first think and evidence that the right decisions were made, but as ever, there is another side to the story – demand is one thing but there is also supply to consider.

The harvest in 2021 turned out to be one of the most difficult in living memory. Grape growers were faced with just about every imaginable problem: frost, storms, heavy rain, diseases in the vineyards and more. The grapes that could be picked were of fair quality, but there were not many of them.

This left many champagne makers with a serious supply problem in 2022 after two consecutive small harvests; demand showed no sign of slowing, in fact the opposite was true, and shipments rose again to 326 million bottles.

Faced with this situation, champagne makers had hard choices to make:

Some simply discontinued sales to customers whom they considered to be of lesser importance;

Others implemented a system of allocation which restricted the number of bottles each customer could order;

Many followed the lead of the major brands who took the opportunity to raise prices as part of a strategy of ‘premiumisation’.

This worked well and the value of shipments reached over 6 billion euros for the first time ever.

All these things had a significant impact on the private brand market because several champagne makers abandoned this business channel for lack of available bottles.

The wheel starts to turn again

Everything that goes up must come down and nothing stays the same for ever. In 2023 we saw what may be the start of another turn of the wheel.

First, the harvest in Autumn 2022 was excellent in terms of both quality and more importantly in terms of quantity. This, together with other measures to help champagne houses to rebuild their reserves, will ease the supply issue, but we are not yet out of the woods just yet because the wines from the 2022 harvest will not be available to sell for a few years yet.

In parallel to gradual easing of supply, sales are also showing signs of a downturn. We are still awaiting the official figures for shipments for the full year in 2023, but the figures up until October 2023 show a fall of 8.6 % versus 2022 and a moving annual total over 12 months of 304 million bottles – not a disaster by any means, but a distinct fall versus the previous year.

As time goes by the reasons for the recent trends becomes clearer.

It now appears that the high level of shipments in 2022 was due in part to the fact that importers around the world were re-stocking again after their warehouses had been all but emptied in 2021. Indeed, the importers probably over-ordered in 2022 just to be sure that they could get their hands on much-needed stock. They now find themselves with more than enough and therefore orders and shipments have slowed down, although actual consumption may be stable.

What’s more, the increase in interest rates over the past year or more means that importers are much more cautious about managing their funds and decided in 2023 to delay or reduce orders where possible.

Rising prices

Another obvious component in the discussion is the rising price of champagne which we referred to above. It seems reasonable to assume that this is having some negative impact on consumption and if this is true it might indicate that there is a limit to the ‘premiumisation’ strategy used primarily, but not exclusively, by the major brands.

However, even as supply eases over the next few years it is hard to imagine that the recent trend towards higher prices will change any time soon.

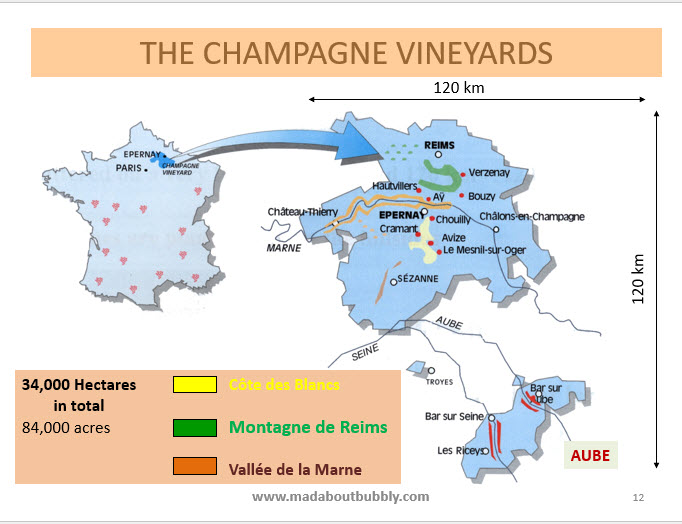

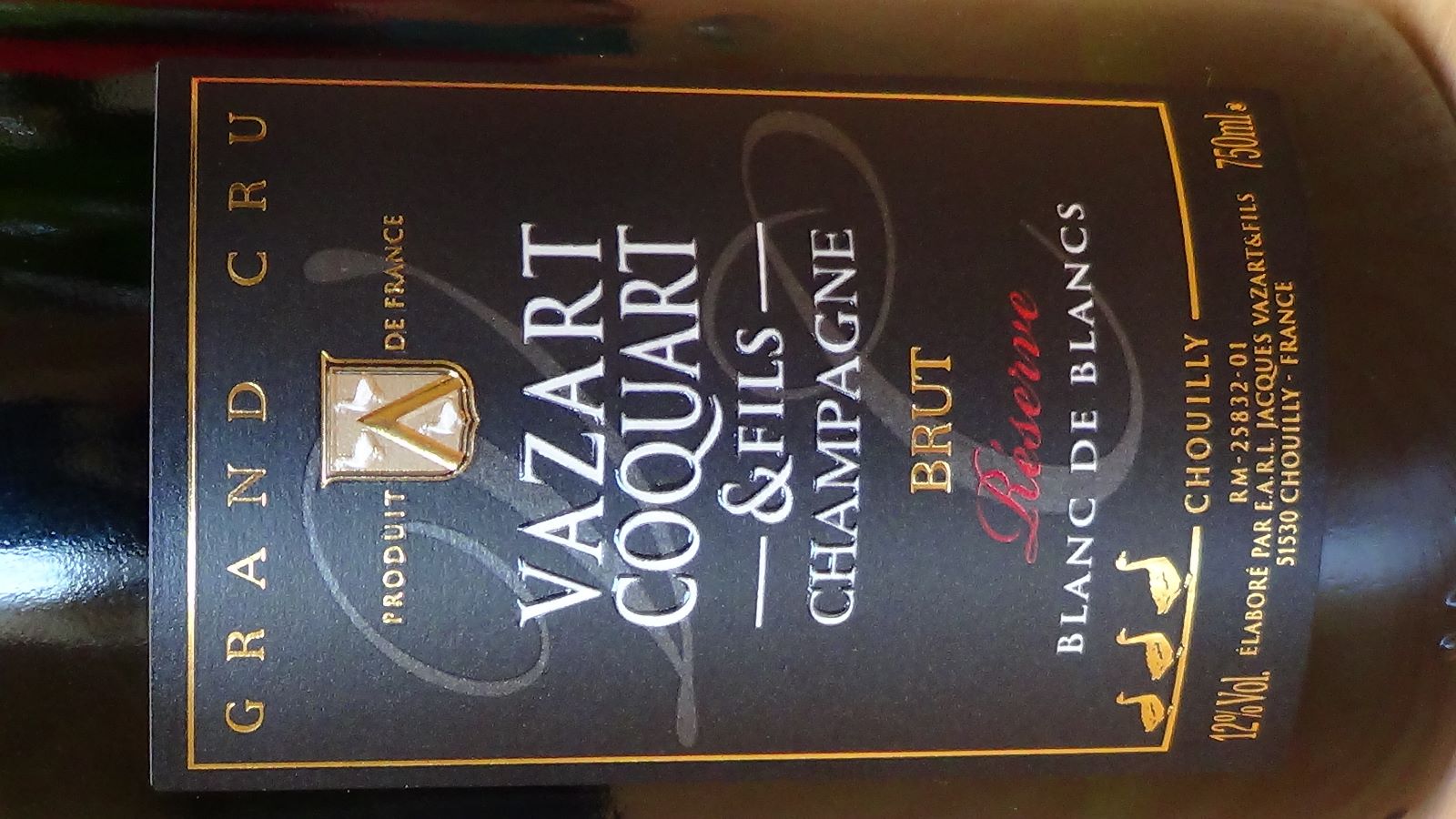

Why not? One need look no further than the price of grapes in Champagne which is once again on the rise - by approximately 40 centimes per kilo in 2023. The price varies quite significantly across the many regions that make up the appellation Champagne and can vary between as much as 8.50 euros per kilo for grapes from the most prestigious Grand Cru villages and 7.50 euros per kilo for grapes from less famous villages*. Bearing in that it requires 1.176 kg of grapes to make every 75cl bottle of champagne, (and that’s before the grapes have even been pressed, let alone anything else) it’s easy to see where the high price of champagne comes from.

The grapes growers also face higher costs due to the increasingly widespread adoption of more environmentally sound practices – all of which have an additional cost attached to them – and to the extremely high cost of vineyard land in Champagne.

* these are the prices on the open market. The price calculation of grapes from one's own vineyard, is different

So where does all this leave us and what lies in store in the next few years, particularly for anyone considering launching a private brand?

First the positive news: my impression is that some champagne makers who, two years ago would not consider releasing stock for a private brand, may be ready to look at this market once again.

The less positive news is that prices will continue to rise.

The total area of Champagne is limited and despite the frequent discussions about expanding the appellation, nothing significant has yet been implemented, or is likely to be in the near future. Accordingly, as things currently stand, production has an absolute limit of about 350 million bottles. We are not at that level yet, but not too far from it. This will inevitably put upward pressure on prices.

Equally, it is unrealistic, in my view, to expect production costs and land prices to do anything but steadily increase and this too will tend to push prices of champagne upwards.

Last but not least, I don’t see established brands abandoning their premium-price strategy and where the big brands lead, others will follow.

Consumer demand

On the demand side, the are signs of that some consumers are reducing the frequency of their champagne purchases and, in some cases, changing to other sparkling wines entirely– one only has to look at the plethora of sparkling wine brands on the market and their almost ubiquitous distribution to appreciate that champagne faces serious and growing competition amongst a certain segment of consumers.

On the demand side, the are signs of that some consumers are reducing the frequency of their champagne purchases and, in some cases, changing to other sparkling wines entirely– one only has to look at the plethora of sparkling wine brands on the market and their almost ubiquitous distribution to appreciate that champagne faces serious and growing competition amongst a certain segment of consumers.

Sparkling wine is one of the only categories of wine to see growth in the past few years. This is especially (but not only) true in the USA because, according to INTEL

“sparkling wine is no longer limited to celebratory occasions in the US. As a result, the segment’s share of the total wine category in the country has grown steadily over the last decade, from 5.4% in 2013 to 7.4% last year.

During the same period, the US went from annual sales of 17m nine-litre cases of sparkling wine to over 26.5m cases.”

https://drinks-intel.com/wine/sparkling-wine-in-the-us-in-2023-market-intel/

However, in my view, this is good for the image and sales of champagne because there is a constant stream of new sparkling wine consumers who, in all probability, will want to try champagne sooner or later.

I also believe that it will be hard if not impossible for other sparkling wines to displace champagne’s image as preeminent in terms of quality and prestige and thus a strong aspirational demand for champagne will always be there.

To comfort me in this view research carried out by Future Market Insights forecasts that the value of champagne shipments will reach 11.2 billion euros in 2032 with an annual compound growth rate of 5.08%

In summary, I remain cautious optimistic for the champagne category as a whole in the next few years and also for the private brand market, not only because it will gradually become easier to find suppliers, but also because consumer demand is growing, prices are rising and the potential for attractive profits remains.

Until next time

Jiles Halling

Regular readers of this bulletin will remember how often I have mentioned the shortage of stock that resulted from two small harvests in 2020 and 2021 coupled with a big increase in demand since the end of the worldwide health incident.

Regular readers of this bulletin will remember how often I have mentioned the shortage of stock that resulted from two small harvests in 2020 and 2021 coupled with a big increase in demand since the end of the worldwide health incident. The obvious and simple answer is that they have responded by increasing prices.

The obvious and simple answer is that they have responded by increasing prices.

Those of you who are already working with me on a private brand project will have heard me refer to forthcoming changes to legislation regarding labelling in the European Union and I can now give you a few more details.

Those of you who are already working with me on a private brand project will have heard me refer to forthcoming changes to legislation regarding labelling in the European Union and I can now give you a few more details. Occasionally clients ask me if it is possible to buy vineyards in Champagne with view to creating a new brand. In theory it is possible although it would not be something I would recommend and if one looks at the annual survey of sales and prices in 2022 the reasons for my hesitation become apparent.

Occasionally clients ask me if it is possible to buy vineyards in Champagne with view to creating a new brand. In theory it is possible although it would not be something I would recommend and if one looks at the annual survey of sales and prices in 2022 the reasons for my hesitation become apparent. As many readers will be aware from my recent Champagne Bulletins, two small harvests in 2020 and 2021 followed in 2022 by a far bigger increase in demand than was expected has put huge pressure on stocks of champagne. Many houses are having to choose between, on the one hand, putting all their customers on allocation in order to supply all of them with something or, on the other hand, ranking their customers and ceasing supplies altogether to the ones they consider least important.

As many readers will be aware from my recent Champagne Bulletins, two small harvests in 2020 and 2021 followed in 2022 by a far bigger increase in demand than was expected has put huge pressure on stocks of champagne. Many houses are having to choose between, on the one hand, putting all their customers on allocation in order to supply all of them with something or, on the other hand, ranking their customers and ceasing supplies altogether to the ones they consider least important.